RYCEF

0.0100

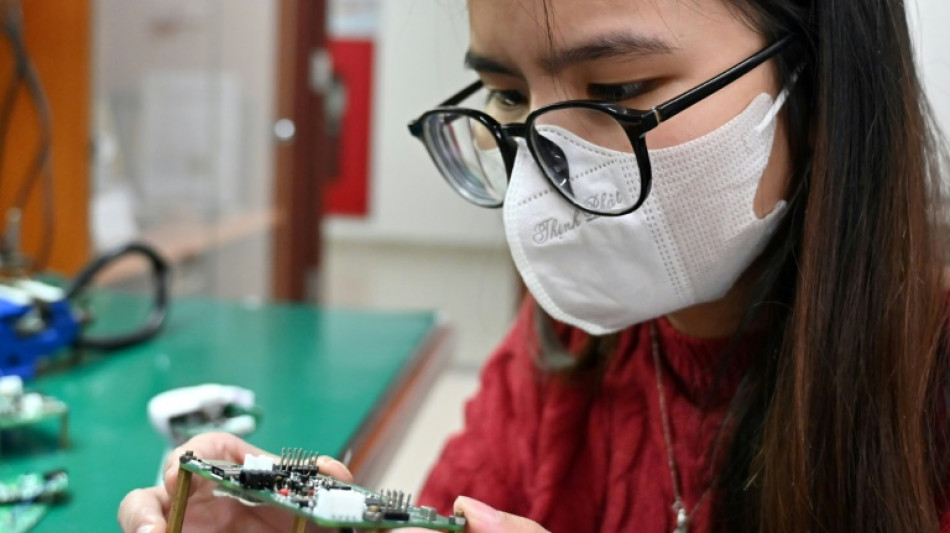

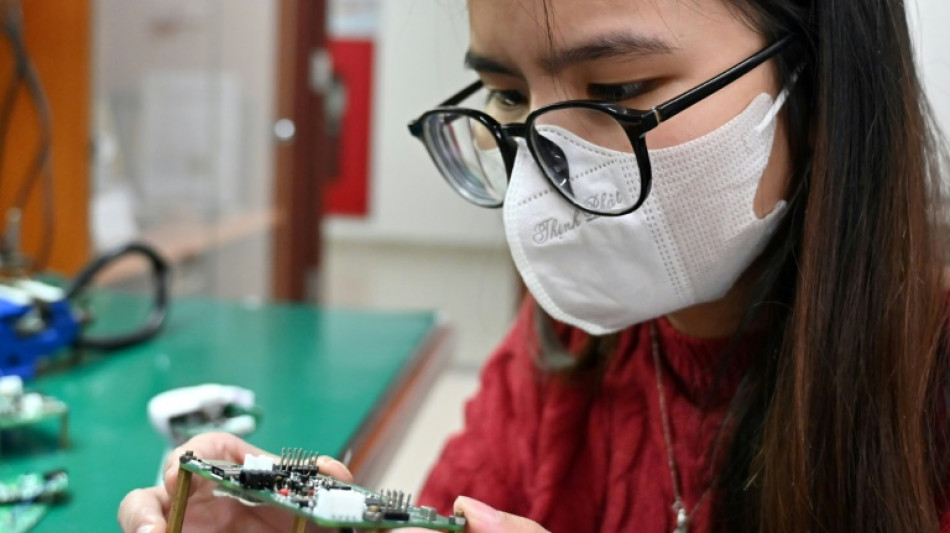

Nguyen Phuong Linh is among a crop of young electronics students crucial to Vietnam's ambitions to become a chips hub.

She's driven, smart and already has her sights set on a professorship -- wanting to train a new generation that could help woo foreign investors eager to diversify semiconductor production away from China and Taiwan.

Long viewed as a low-cost destination to make clothes, shoes and furniture, Vietnam is now eyeing a rapid climb up the global supply chain and has put computer chips at the heart of its development plans.

It is a goal that suits nations such as the United States -- increasingly worried about economic tensions with Beijing -- but there are huge hurdles to overcome, chiefly a shortage of highly skilled engineers.

"Chips are attracting so much attention... among both the government and the public," Linh told AFP from a tiny windowless lab at Hanoi's University of Science and Technology, crowded with computers.

"I used to dream of working as a chip designer but now I want to be a professor. I think our country needs more teachers to create a better workforce," the 21-year-old said.

Vietnam's market for semiconductors, which are used in everything from smartphones to satellites and to power AI technology, is expected to grow at 6.5 percent a year, reaching $7 billion by 2028, according to Technavio, a market research firm.

During a visit to the capital last year, US President Joe Biden announced deals to support Vietnam's chips industry, and shortly after, Nvidia -- an American giant in the sector -- said it wanted to set up a base in the country.

South Korea's Amkor and Hana Micron both opened packaging factories last year in Vietnam, which is already home to US firm Intel's largest factory for assembling, packaging and testing chips.

As the hype around Vietnam's emerging chips industry ramps up, its communist government has said the country's current pool of around 5,000 semiconductor engineers must jump to 20,000 in the next five years -- and to 50,000 over the next decade.

Earlier this month, Deputy Prime Minister Tran Luu Quang made an official request to the CEO of South Korea's Samsung, asking the electronics giant to help.

Vietnam is currently producing just 500 qualified engineers per year, according to Nguyen Duc Minh, a professor of integrated circuit (IC) design who teaches Linh.

"We need to do much more to reach the target," he told AFP. "I think this is a very challenging figure."

- Brain drain risk -

Many electronics students already know what role they want to play in the semiconductor field, with Linh's classmate Dao Xuan Son eyeing a job at Intel.

But the pathway Vietnam's leaders want to take is less easy to understand, according to Nguyen Khac Giang, visiting fellow at the ISEAS-Yusof Ishak Institute in Singapore.

"Do they want to achieve a national champion Samsung-like Vietnamese company in semiconductors, which requires a lot of capital and investment?" he asked.

"Or do they simply want to attract more investment in the semiconductor business in Vietnam?"

Experts also seem unclear about how the government arrived at the 50,000 engineer figure, and whether they are needed for chip design or factory work.

"We talk of a very huge number but it seems we have not looked to see whether the industry really needs that big number of graduates," IC design professor Pham Nguyen Thanh Loan said.

Intel told AFP that their focus in Vietnam would remain on assembly and testing, the lowest-value part of the semiconductor supply chain.

"We face a challenge in expanding our talent pool beyond these areas," said Kim Huat Ooi, vice president in manufacturing, supply chain and operations, and general manager of Intel Vietnam.

Several universities launched additional programmes this academic year that focus on semiconductor and chip design.

But more importantly, professors say, Vietnam needs to invest in quality training that allows students to gain practical skills demanded by the world's top firms.

Although courses are often good on theory, "we need more investment in infrastructure and equipment for students to practise", professor Minh told AFP.

Among those top graduates who do come through, there is "real risk" of brain drain to the world's top chip-making nations, said analyst Giang.

"Let's be honest, the salary in Vietnam is quite low, even for those with very high skills," he said.

"They might get the feeling... it's probably better to just move to Taiwan."

Linh says she is keen to study abroad to gain better connections to industry, but she is set on returning home.

Final year student Son, however, dreaming of a design position with Intel, would be happy to study -- and then stay overseas for a few years.

"I can learn more -- and have more opportunities -- outside Vietnam," Son said.

T.Gilbert--TFWP